ESG Investment is moving from a niche player to a mainstream investment proposition. ESG facts are now becoming prominent in investment decision-making. Investors want to make their voices heard in corporate decision-making. Regulation, too, is becoming a major driver propelling responsible investment worldwide. The concern about greenwashing has led investors to improve transparent reporting significantly. The business imperative of climate impact on corporate profits is being realized.

Corporations will push suppliers and vendors to reduce GHG emissions and move towards a net-zero emission regime. For instance, big corporations like Amazon, Microsoft, Alphabet, and Alibaba are becoming drivers of green investment. It began with these corporations opting to buy renewable energy for their operations. Doing that will help reduce Scope 1 and 2 emissions.

Amazon has pledged to achieve 100% renewable energy use in its global operations by 2025 and has already invested in wind and solar projects to help achieve this goal. Microsoft has also committed to becoming carbon negative by 2030. It has purchased renewable energy credits and invested in wind and solar projects in several countries to help offset its carbon emissions. Alphabet has also made significant investments in renewable energy sources, including a 1.6 GW package of wind and solar power purchase agreements, which it claims is the largest corporate purchase of renewable energy in history. Alibaba has also pledged to achieve carbon neutrality by 2030 and has made significant investments in renewable energy projects in China, such as a solar power station that can generate 100 million kWh of electricity annually.

Renewable energy costs have decreased recently, making it increasingly competitive with traditional fossil fuels. For example, the levelized cost of electricity (LCOE) for wind and solar power has declined significantly in many regions, making them economically attractive options for many companies. The declining cost of renewable energy has made it easier for companies to achieve sustainability goals while reducing energy costs.

Here are some green initiatives of these corporations:

- Amazon:

- In the United States, Amazon has invested in wind and solar projects in states such as Texas, Virginia, and California.

- Amazon has signed European power purchase agreements (PPAs) for wind and solar projects in the UK, Sweden, and Spain.

- In Australia, Amazon has invested in a wind farm in New South Wales to power its data centers.

- In India, Amazon has invested in a 260 MW solar project in Telangana to power its operations.

- Microsoft:

- In the United States, Microsoft has invested in wind and solar projects in states such as Texas, Wyoming, and Virginia.

- In Europe, Microsoft has signed PPAs for wind and solar projects in countries such as Sweden and the Netherlands.

- In Asia, Microsoft has invested in a 60 MW solar project in Singapore to power its data centers.

- Alphabet:

- Alphabet has invested in wind and solar projects in states such as Texas and Oklahoma in the United States.

- In Europe, Alphabet has signed PPAs for wind and solar projects in countries such as Sweden, Norway, and Finland.

- Alphabet has invested in an 80 MW solar project in Chile to power its data centers.

- Alibaba:

- In China, Alibaba has invested in solar power projects in provinces such as Anhui, Zhejiang, and Qinghai.

- In Australia, Alibaba has invested in a 50 MW solar project in New South Wales to power its data centers.

However, it is worth noting that even companies that have made significant commitments to renewable energy may still use fossil fuels to some extent, especially in regions where renewable energy infrastructure is not yet fully developed. In some cases, companies may use fossil fuels as a backup or to supplement their renewable energy sources when there is not enough wind or solar power available.

That being said, all four of these companies have made significant commitments to renewable energy and are actively seeking to transition away from fossil fuels wherever possible. In many regions worldwide, renewable energy sources are becoming increasingly competitive with traditional fossil fuels, making it easier and more cost-effective for companies to transition to renewable energy.

Downstream suppliers to Amazon, Microsoft, Alphabet, and Alibaba are also encouraged to transition to renewable power. These companies recognize that their supply chains can significantly impact their overall carbon footprint and are working to reduce their emissions by promoting sustainability throughout their supply chains.

These companies encourage their suppliers to transition to renewable power by setting renewable energy targets and requiring them to report on their energy use and greenhouse gas emissions. For example, Amazon has set a goal to power its operations with 100% renewable energy by 2025 and is working with its suppliers to help them achieve their own renewable energy goals. Microsoft has set a goal to become carbon negative by 2030 and is working with its suppliers to develop low-carbon solutions throughout its supply chain.

In addition to setting targets and providing support, these companies leverage their purchasing power to drive demand for renewable energy. By entering into long-term power purchase agreements (PPAs) for renewable energy, these companies are creating a stable market for renewable energy and a signal to energy suppliers that there is a demand for clean energy.

Overall, these companies recognize the importance of working with their suppliers to help transition to renewable power and are taking a proactive approach to promote sustainability throughout their supply chains. These trends are throwing up opportunities for the investment community too. While these tech giants are cash rich, their suppliers need investment for growth. Investors see a business opportunity here. Investors are increasingly recognizing the importance of sustainability and are looking for companies to take action to reduce their carbon footprints and promote renewable energy.

A supplier looking to get competitively priced green investment is to work with the investment models and programs set by investors. Investors support greener fuels by investing in companies committed to sustainability and renewable energy. For example, many investment firms now have dedicated funds for renewable energy and sustainability. They actively seek to invest in companies that positively impact the environment.

In addition to direct investment in renewable energy and sustainability-focused companies, investors also use their influence to push companies to adopt more sustainable practices. For example, many large investment firms have become more active in shareholder engagement, using their voting power to push for company policies and practice changes.

Some examples of ESG Investment institutions that are actively supporting the move to greener fuels include:

- BlackRock: The world’s largest asset manager has made sustainability a key focus of its investment strategy and is actively pushing for companies to adopt more sustainable practices.

- State Street Global Advisors: This investment firm has launched several sustainable investment funds and is using its voting power to push for greater sustainability among the companies it invests in.

- Vanguard: This investment firm has launched several sustainable investment funds, pushing for greater transparency and disclosure around companies’ environmental, social, and governance practices.

- Caisse de dépôt et placement du Québec: This Canadian investment firm has committed to invest $32 billion in renewable energy and other sustainable infrastructure projects over the next five years.

Overall, the investor community is important in driving the move to greener fuels and supporting the transition to renewable energy among downstream suppliers of Amazon, Microsoft, Alphabet, and Alibaba. Amazon, on its own, has created a $2 billion Climate Pledge Fund to invest in companies developing sustainable technologies. It also works with its suppliers to help them transition to renewable energy and other sustainable practices.

Suppliers look for the cheapest and most convenient supplier of funds for growth. The cost of green funds for suppliers of Amazon, Microsoft, Alphabet, and Alibaba will depend on various factors, including the demand for sustainable investment opportunities, the availability of incentives and support from the companies they supply, and the overall market conditions for green funds. However, there are certainly opportunities for suppliers to access lower-cost financing and investment opportunities by adopting more sustainable practices and embracing the transition to renewable energy.

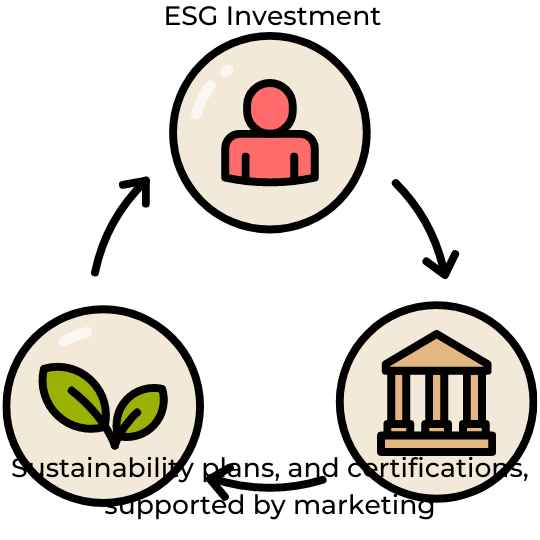

Suppliers looking to attract ESG investment funds must strengthen their green credentials. To strengthen your green credentials and attract competitively priced green investment funds as a supplier, you can take the following steps:

- Develop a sustainability strategy: Develop a sustainability strategy that outlines your goals, targets, and action plan for reducing your environmental impact. This can include reducing greenhouse gas emissions, energy consumption, and water usage and improving waste management and sustainable sourcing practices.

- Measure and report your sustainability performance: Measure your sustainability performance and report your progress regularly to your stakeholders, including investors, customers, and suppliers. Use standardized sustainability reporting frameworks such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) to ensure your reporting is transparent, comparable, and reliable.

- Obtain third-party certifications such as LEED, B Corp, or ISO 14001 to demonstrate your commitment to sustainability and environmental responsibility. These certifications can independently verify your sustainability performance and help build trust with investors.

- Engage with your customers and suppliers to understand their sustainability goals and priorities and identify opportunities for collaboration and innovation. You can demonstrate your leadership and commitment to sustainability by working together to achieve shared sustainability objectives.

- Invest in sustainable technologies and processes that can reduce environmental impact and improve operational efficiency. This can include renewable energy, energy efficiency measures, circular economy practices, and sustainable packaging solutions.

- Join industry associations and networks that focus on sustainability issues and best practices. This can help you stay up-to-date on the latest sustainability trends and innovations and build your reputation as a responsible and sustainable supplier.

Overall, by developing a clear sustainability strategy, measuring and reporting your sustainability performance, obtaining third-party certifications, engaging with your customers and suppliers, investing in sustainable technologies, and joining industry associations and networks, you can strengthen your green credentials and attract competitively priced green investment funds as a supplier.

ESG Investments are in the business of deploying financial assets for profit. Therefore, it is natural for funds to identify funding businesses aligned with customer preferences. It is in this context that we need to see ESG funding. Fund evaluation processes are now factoring in climate risk when calculating investment returns. They also look at the internal governance processes of companies to see if they are compatible with societal preferences toward a greener, climate-friendly world.

As good businesses, ESG funding aligns themselves with the customers of companies they plan to invest in because this alignment will give them superior returns.

Supporting credentials:

Climate change: Financial risks and Opportunities